Condo Insurance in and around Ardmore

Unlock great condo insurance in Ardmore

Protect your condo the smart way

Home Is Where Your Heart Is

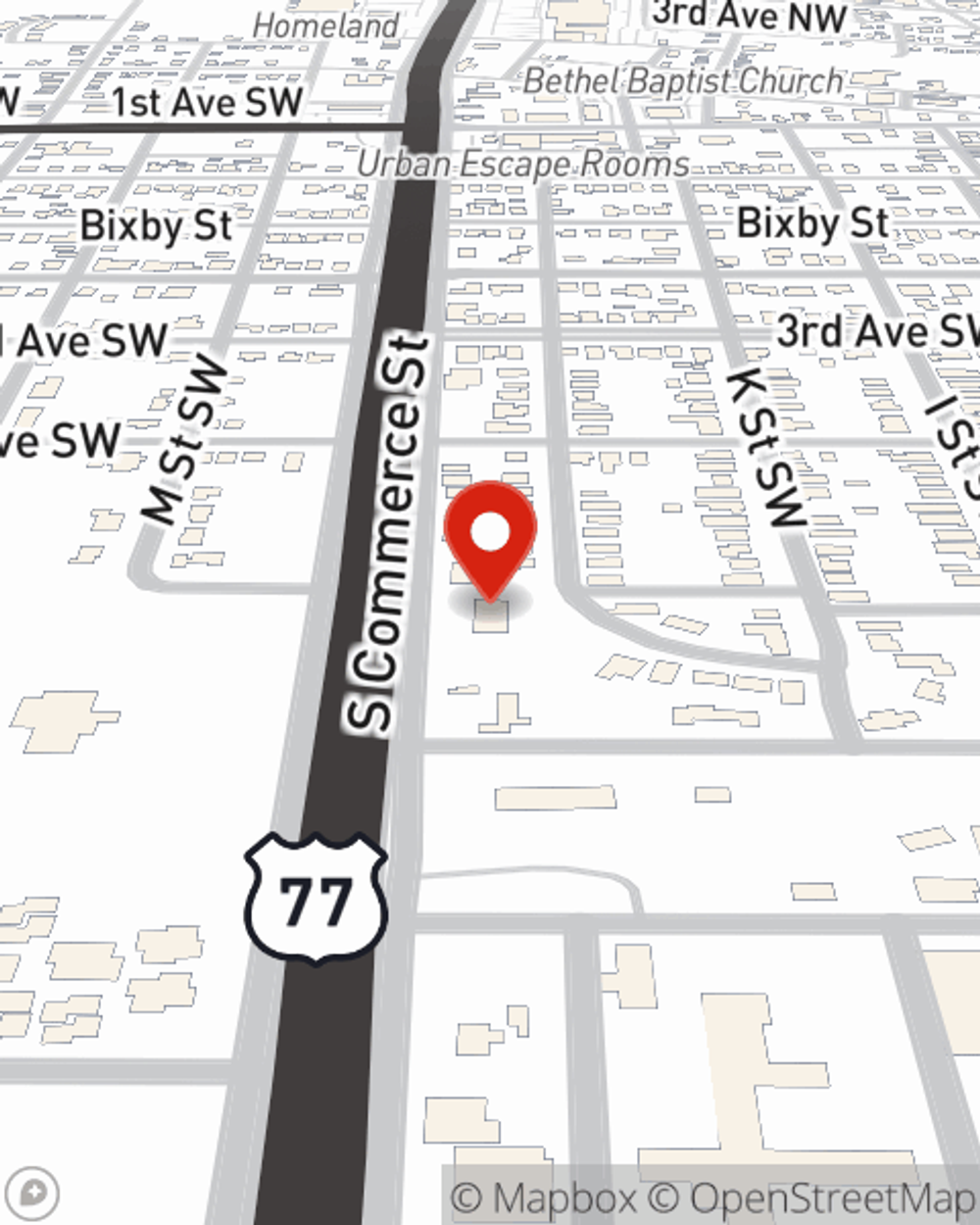

There are plenty of choices for condo unitowners insurance in Ardmore. Sorting through savings options and providers isn’t easy. But if you want competitively priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Ardmore enjoy unmatched value and straightforward service by working with State Farm Agent Amber Knight. That’s because Amber Knight can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as appliances, swing sets, electronics, pictures, and more!

Unlock great condo insurance in Ardmore

Protect your condo the smart way

Protect Your Condo With Insurance From State Farm

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condominium from vandalism, an ice storm or theft.

As a value-driven provider of condo unitowners insurance in Ardmore, OK, State Farm helps you keep your home protected. Call State Farm agent Amber Knight today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Amber at (580) 223-0391 or visit our FAQ page.

Simple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Amber Knight

State Farm® Insurance AgentSimple Insights®

Condo insurance basics

Condo insurance basics

Condo insurance coverage works in tandem with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.