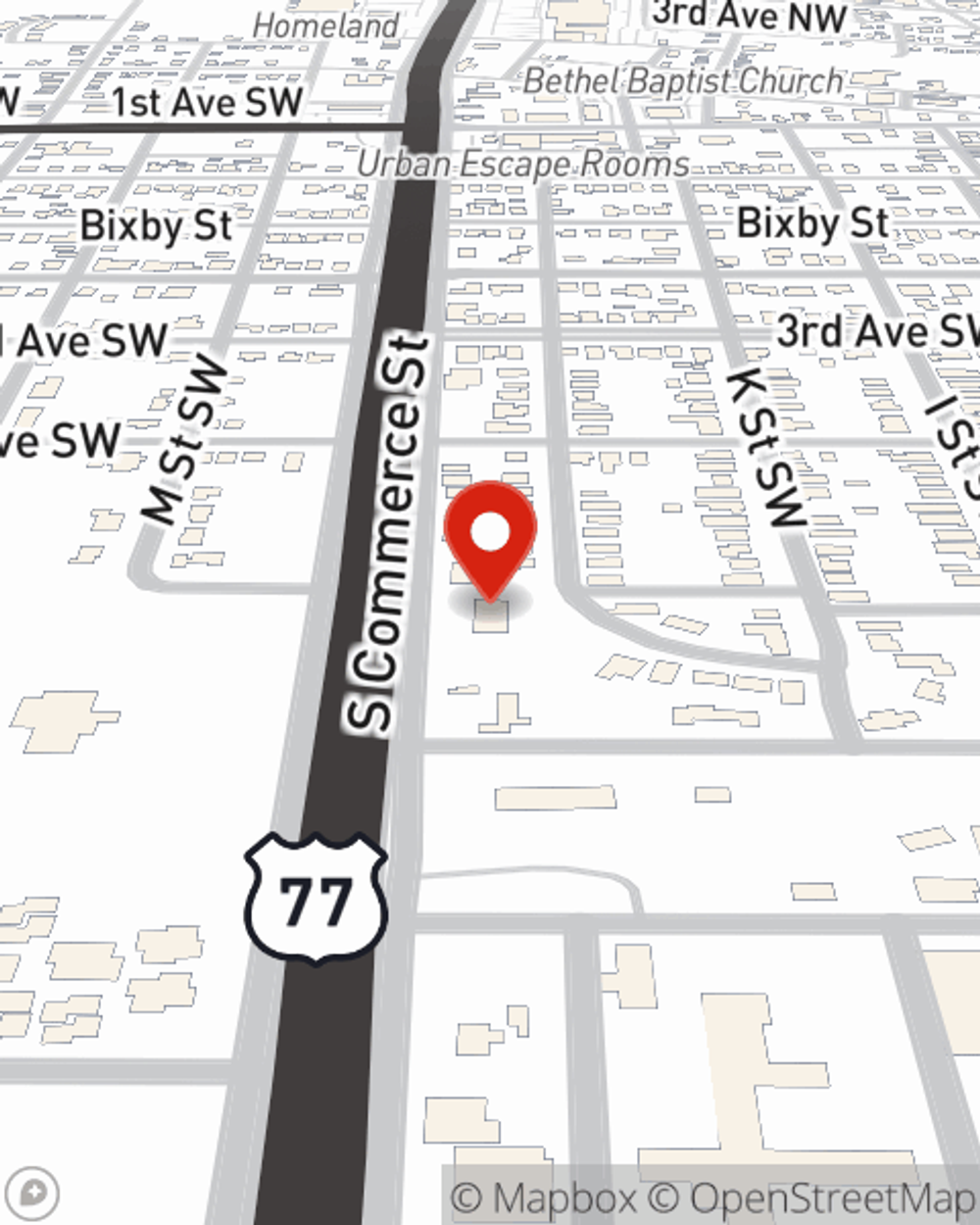

Life Insurance in and around Ardmore

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It may make you uneasy to think about when you pass, but preparing for that day with life insurance is one of the most significant ways you can express love to your family.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Why Ardmore Chooses State Farm

The beneficiary designated in your Life insurance policy can help cover important living expenses for the people you're closest to when you pass away. The death benefit can help with things such as future savings, retirement contributions or grocery bills. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, reliable service.

Don’t let worries about your future stress you out. Contact State Farm Agent Amber Knight today and see how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Amber at (580) 223-0391 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Amber Knight

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.